Wealth Advising

My Approach: Employing today’s technology to help bring financial harmony to 25-45 year olds looking to create a financial framework that fits their lifestyle.

Email me or schedule a meeting below and let’s see what I can do for you!

Client Archetype

25-45 Year Old

This age range has tremendous upside potential for a stress-free retirement but isn’t reached by the financial services industry until later in life. There are plenty of high-income earners in this age range who would benefit greatly from early, high-quality, attentive, financial services.

Film Industry

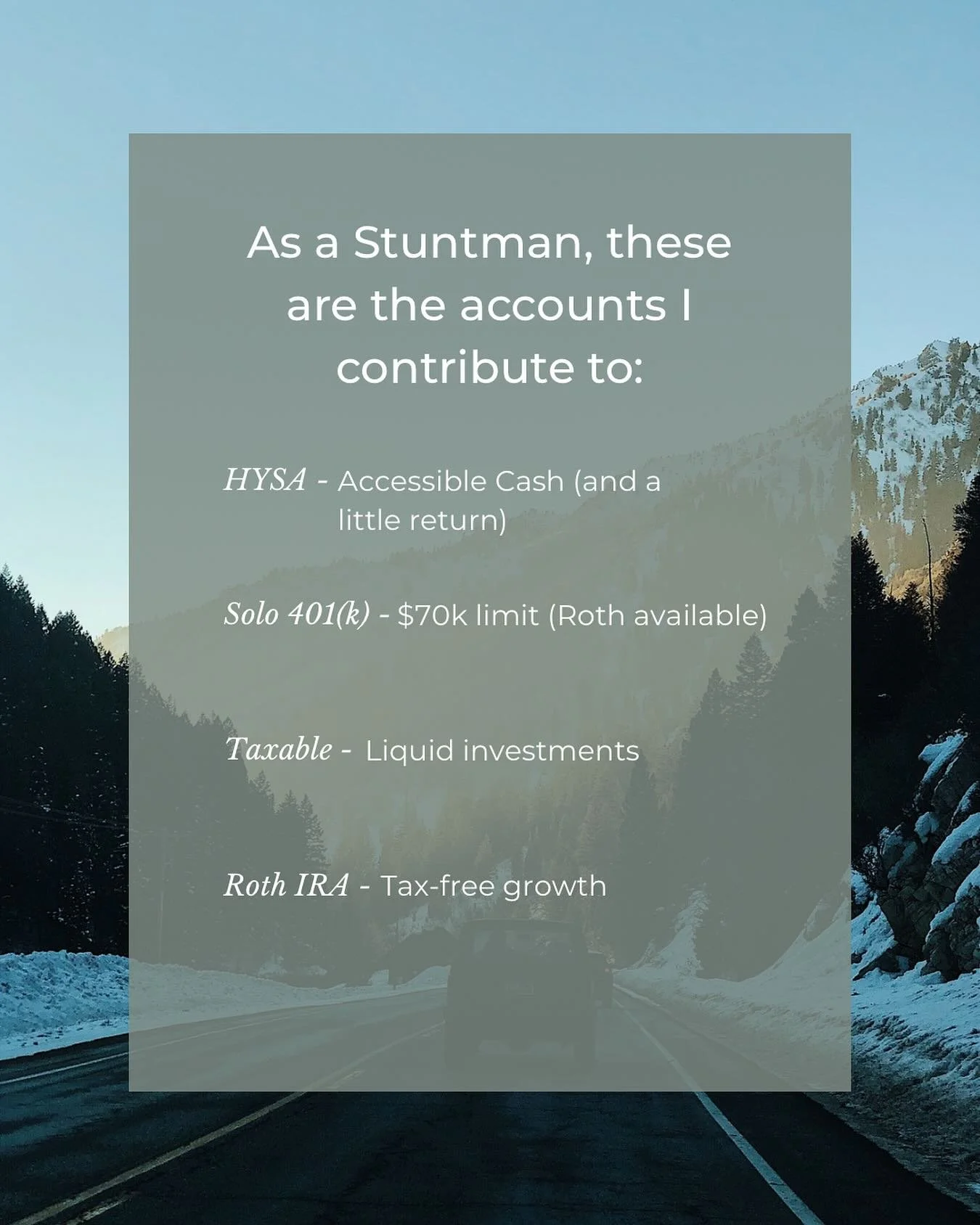

This demographic has yet to be reached by the financial services industry, and I aim to help change that. Many are business owners, which calls for nuanced approaches to their financial situation. I want to meet clients where they’re at and help create a financial framework that fits their lifestyle.

NIL Athletes

Collegiate athletes have unprecedented wealth opportunities available to them. Unfortunately, the personal finance landscape can be complex and confusing. My goal is to help maximize earnings and make sound financial decisions that will benefit them long after their college careers.

What We Do

-

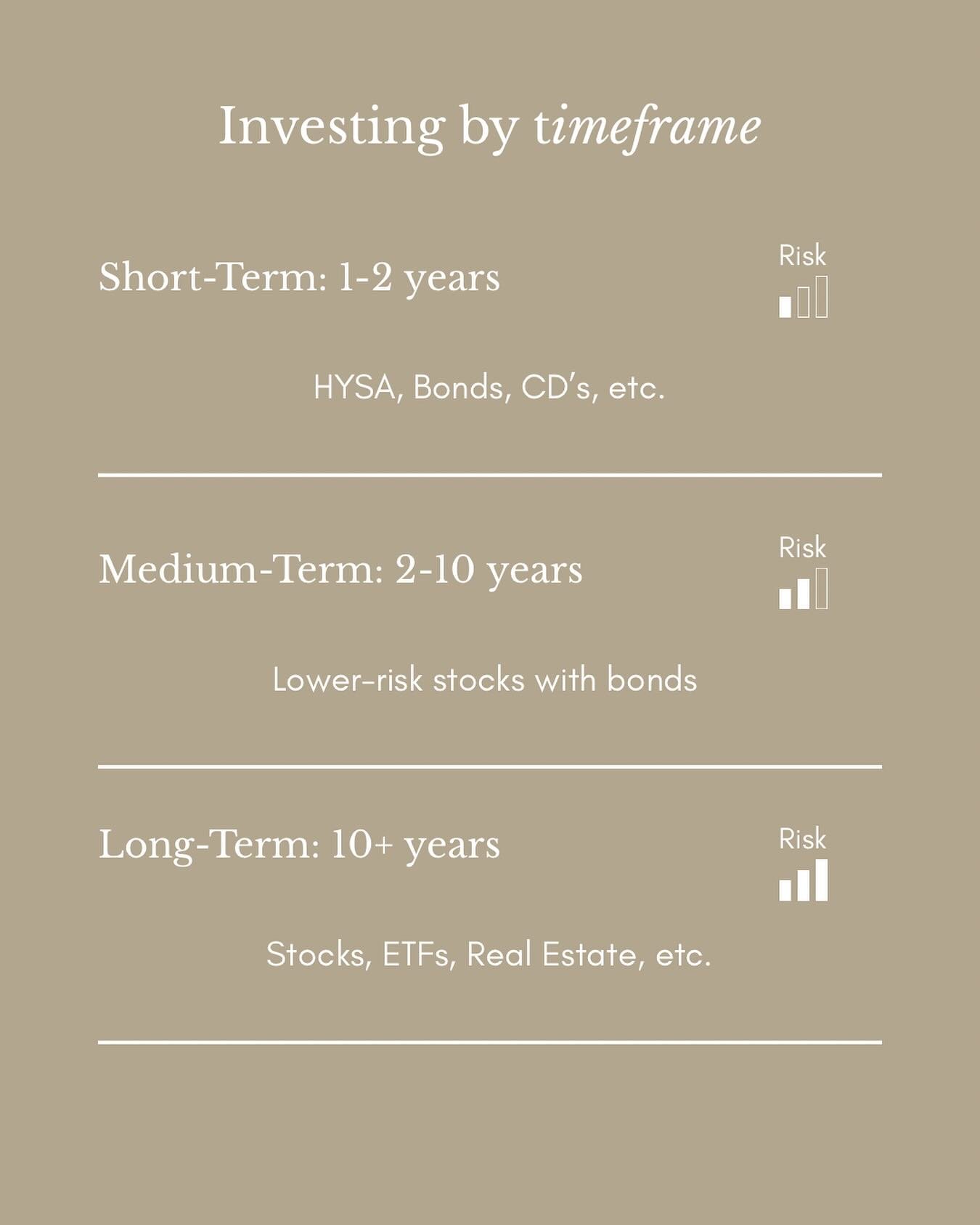

Our investment process is tailored to each client's unique situation. We are committed to cost-effective investments that align with our client's risk tolerance and time horizons.

-

Our comprehensive planning service looks at all aspects of your life with the goal of creating a seamless transition into retirement. Our tailored strategies aim to align your financial situation with your life goals.

-

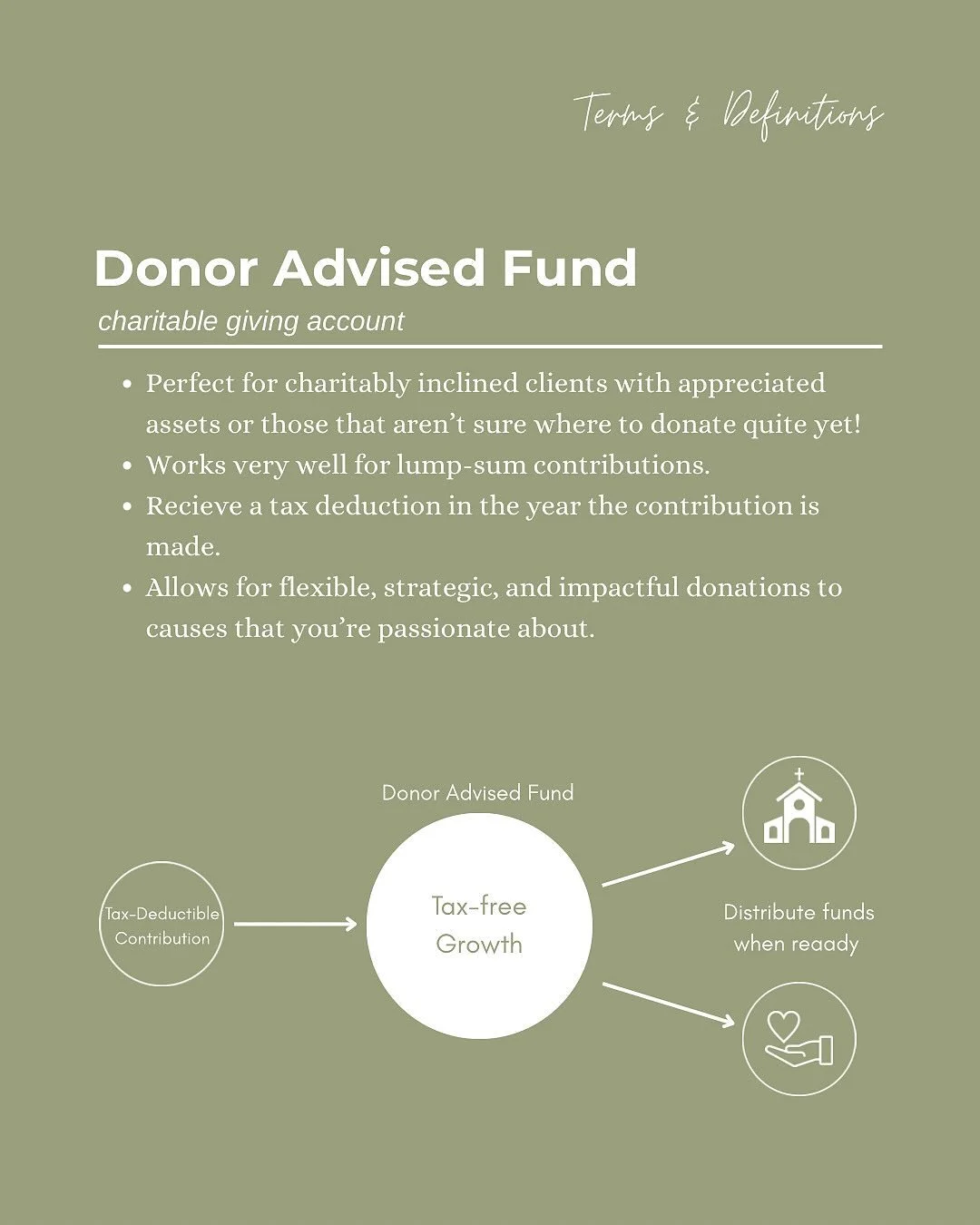

Our tax planning services are designed to help you navigate the complexities of the tax system while maximizing your financial efficiency. We work to identify and evaluate proactive and efficient solutions in an effort to minimize tax burdens year to year.

-

We create tailored estate plans that align with family values and desired goals. We focus on protecting your legacy and assets, minimizing wealth transfer taxes and maximizing distributions to heirs.

Investment Advisory Services offered through Glasgow & Associates, LLC. Glasgow & Associates is a Registered Investment Adviser regulated by the North Carolina Secretary of State Securities Division. Additional information about Glasgow & Associates is available on the SEC’s website at www.adviserinfo.sec.gov.

FAQ

-

WHAT IF I DON'T LIVE LOCALLY?

That's no problem at all! I have clients on both coasts of the US. With the technology at our disposal today, I can provide you with the exact same service regardless of location through video chats, DocuSign, and a host of other software.

Distance is no longer an issue!

-

WHAT DO YOU DO?

1) Operate as advisor, strategist, and communicator to help my clients manage, maintain, and build their wealth.

2) Help educate clients on their finances and how it all works within the ecosystem of their life.

-

HOW WILL OUR RELATIONSHIP WORK?

Our relationship can look exactly how you want it to! I'll always be available for quick phone calls and we'll have meetings throughout the year. Whether it's in the office, over the phone, or via video call, we'll be able to meet your unique needs.

-

WHO IS YOUR IDEAL CLIENT?

The ideal client is someone who is comfortable working via video call, who doesn’t need to meet in a physical office, and who is ready to actively buy in to the process.

-

IS THERE ANY LONG-TERM COMMITMENT?

No, clients are free to leave at any time without long-term commitment. Fees are prorated and refunded if you leave mid-quarter.

-

HOW MUCH DO YOU CHARGE?

For investment management, our AUM fee schedule is as follows:

Portfolio Size Maximum Annual % Up to $500,000 1.50% $500,001 - $1,499,999 1.25% Over $1,500,000 Determined at Engagement

We don't make commission on trades, we are a fee-based, fiduciary firm, so you can rest assured knowing our investment strategies are always working in your best interest.

For financial planning services, we charge $250/hour.

Instagram Feed

Articles

Why the Stunt Industry Needs Wealth Advisors

Why the Stunt Industry Needs Wealth Advisors